when tax filing takes only 5 minutes, everybody wins

contact

- +372 610 1990

- info@nortal.com

company profile- visit website

digital tax administration

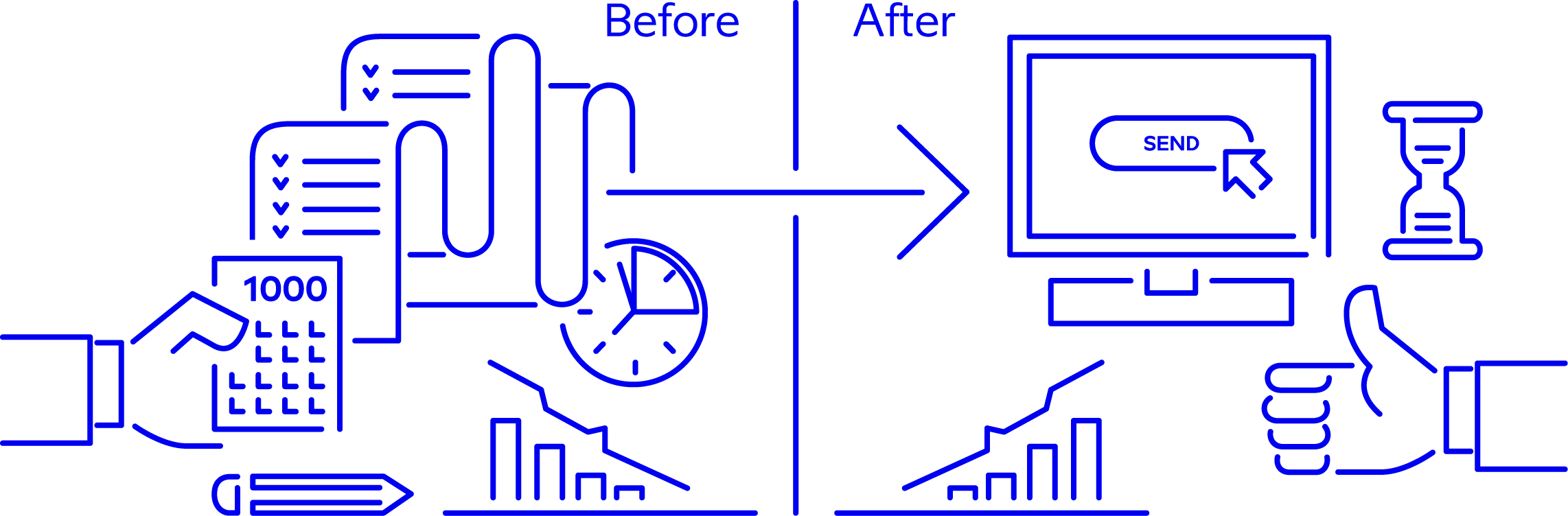

Having people spend hours or even a whole day filing tax returns, creates an enormous drag on everyone’s resources. In countries that have adopted electronic tax filing, the process can take just 5 minutes, or even less.

The Digital Tax Administration concept extends far beyond easy filing. It can involve entirely replacing an existing tax system, introducing new processes and work concepts such as tax intelligence and risk management.

Introducing DTA will help build a smarter and more efficient tax organization that makes better decisions.

KEY BENEFITS

- Reduced administrative burden

- Reduced tax gap

- Countless hours saved by taxpayers, entrepreneurs and the state

- Boost in economic growth

TARGETS

- Finance ministries

- Economics ministries

- Business associations

references

- Nortal played a substantial role in creating Estonia’s acclaimed tax solution, ranked by the Tax Foundation as the most competitive system in the OECD.

- In 2014, Nortal launched an online tax filing and payment system for the Botswana Unified Revenue Service (BURS). See how the system benefits ordinary people.

- Nortal is building on its earlier Botswana experience to streamline the country’s entire tax system.